Complete financial visibility where it matters most

Priority’s financial management ERP software provides powerful financial insights, empowering you to make strategic decisions with high accuracy and gain better control over your finances. With advanced capabilities in accounting, regulatory, cash and budget management, billing, revenue recognition, reconciliation and process automation, Priority’s Financial Management solution boosts your operations and helps you achieve smarter workflow management.

Key features

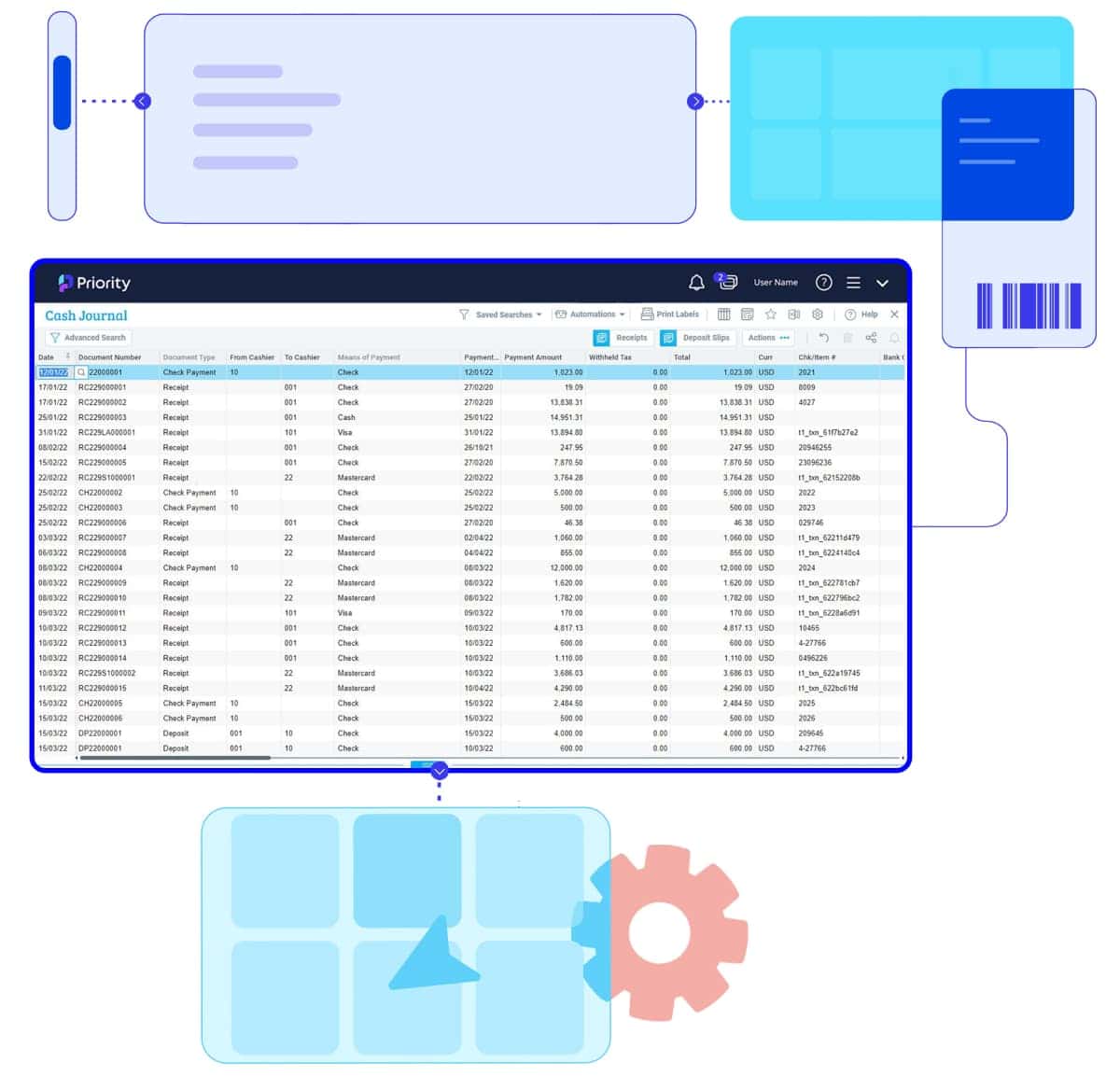

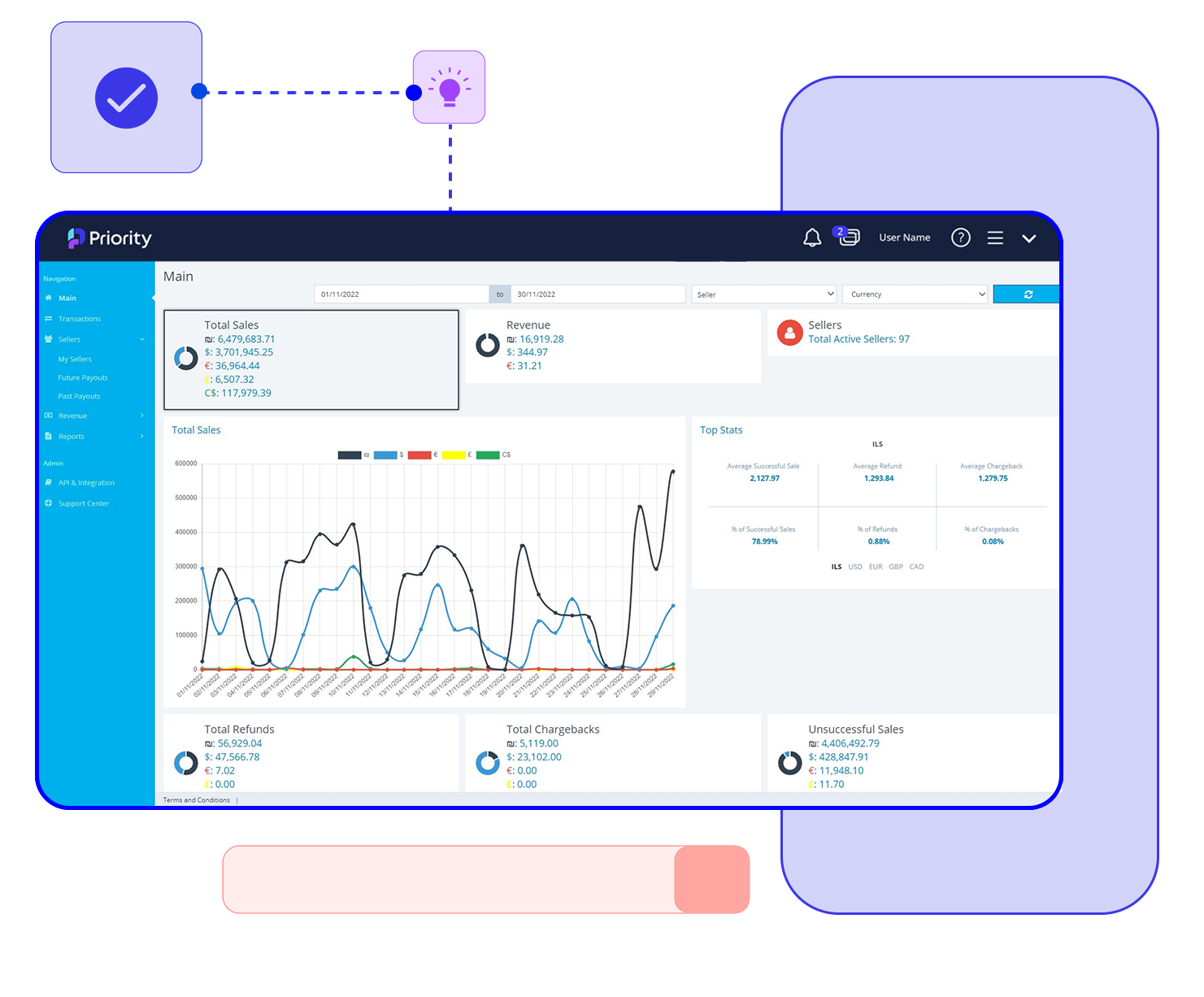

Cash management

Optimize financial processes through real-time visibility into financial transactions and automate payment processing for better-informed decisions. Conveniently manage financial tasks, including checking account balances, transferring funds, and paying bills, with digital banking. Save time and effort and provide greater control and flexibility in managing company finances.

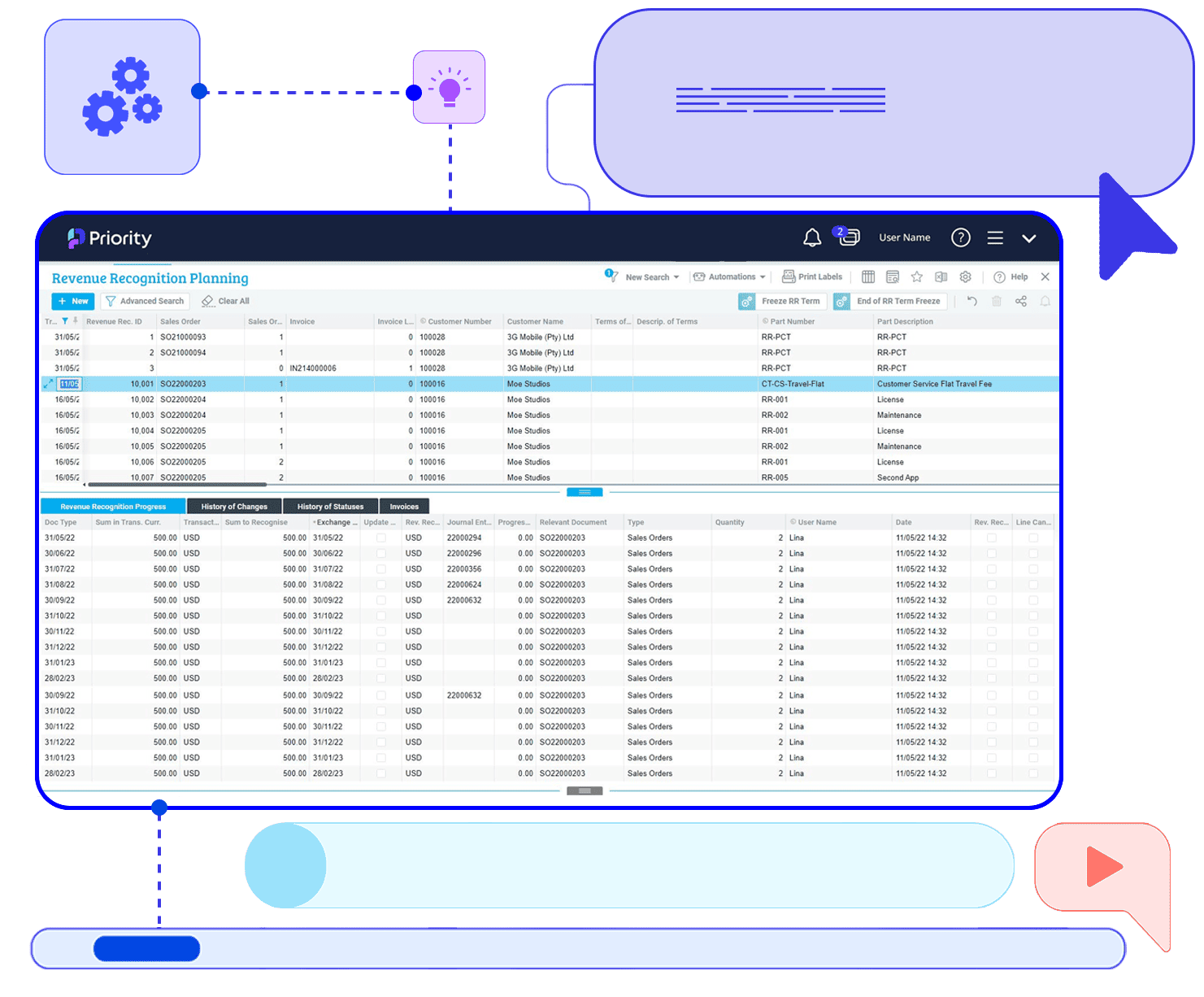

Billing

Bill customers easily based on best practices with various billing methods and functions, including project-based billing, recurring revenues, delivery-based billing, and revenue recognition. Automate invoicing and cash flow management for streamlined control rather than relying on a labor-intensive, time-consuming, and error-prone manual process.

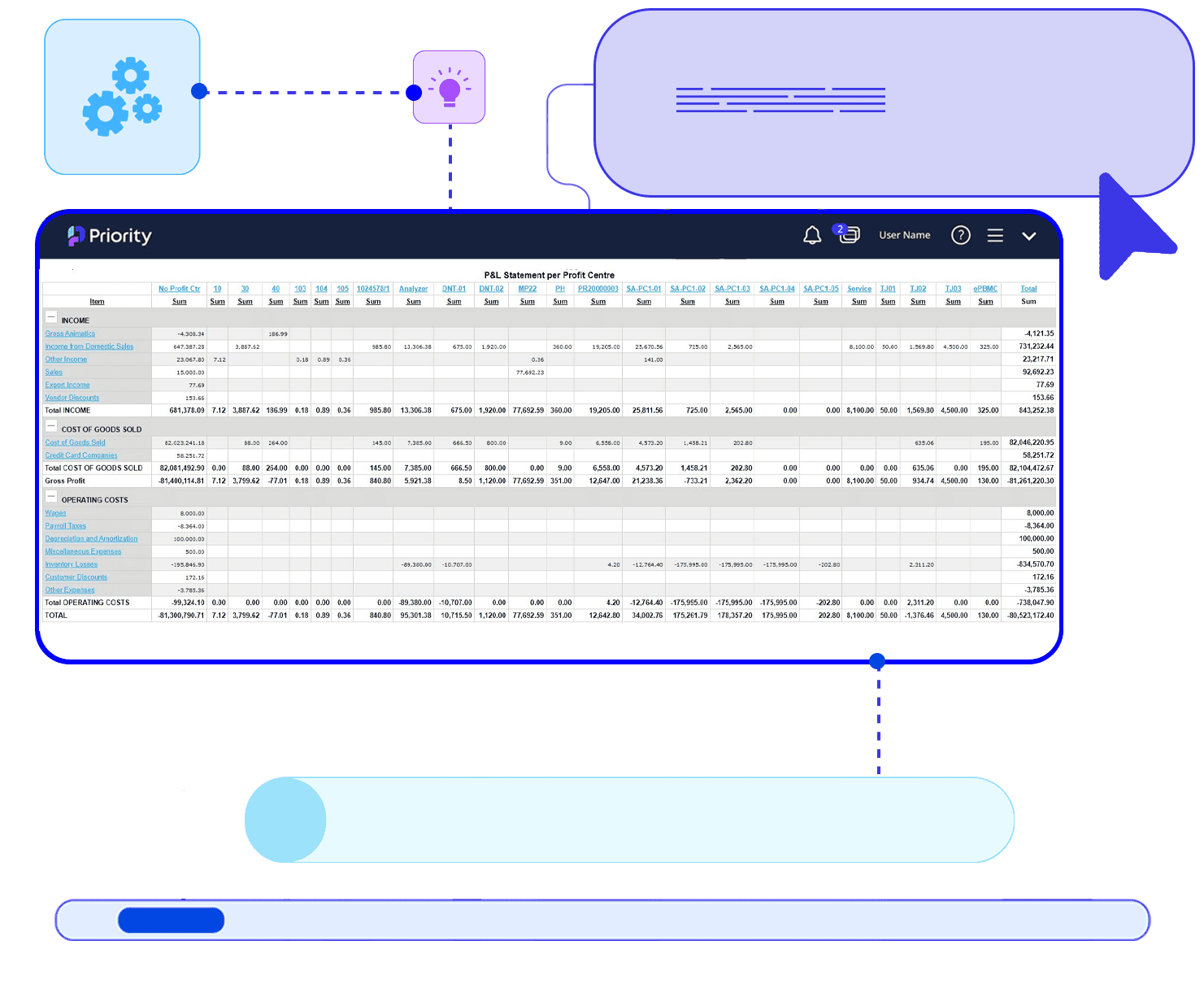

Profit control

Achieve greater profitability by efficiently controlling the profit of each business unit and identifying and reducing unnecessary expenses with real-time visibility into financial data. Track and analyze expenses, make informed decisions about optimizing spending, and improve profitability.

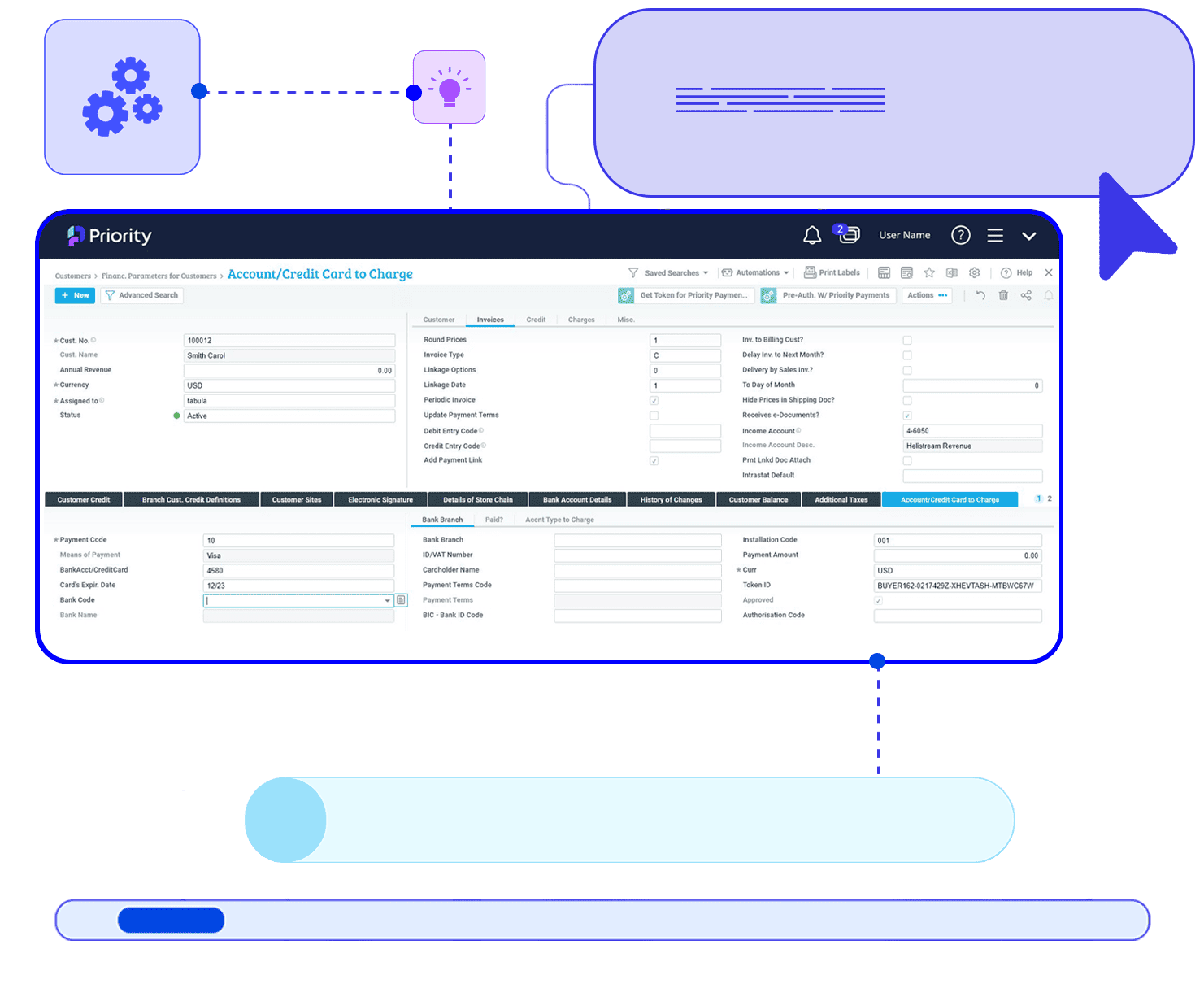

Payments

Streamline customer payments with our fully integrated payment solution. Our smart tools and advanced payment functionalities support various payment methods, including credit cards, PayPal, ACH, and more. Accessible from any platform, desktop, or mobile device, our solution ensures convenient payment processing anytime.

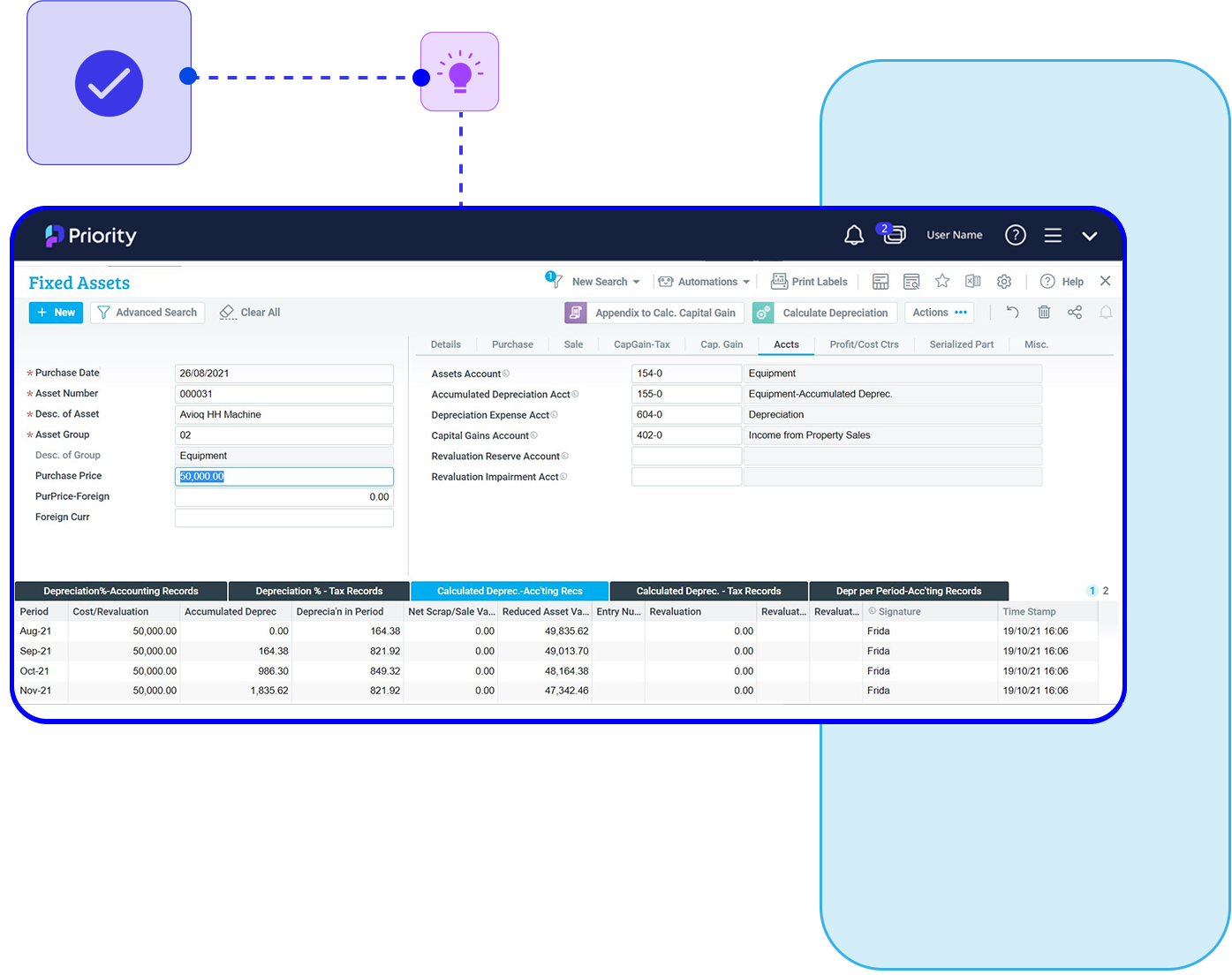

Fixed assets

Efficiently manage the fixed asset lifecycle with seamless integration to accounts payable, inventory management, and general ledger. Calculate tax and book depreciation, manage sales, proposals, adjustments, and revaluations using multiple methods of business asset input. Record asset data automatically in a fixed asset journal to streamline back-office asset operations management.

Case studies

FAQ’s

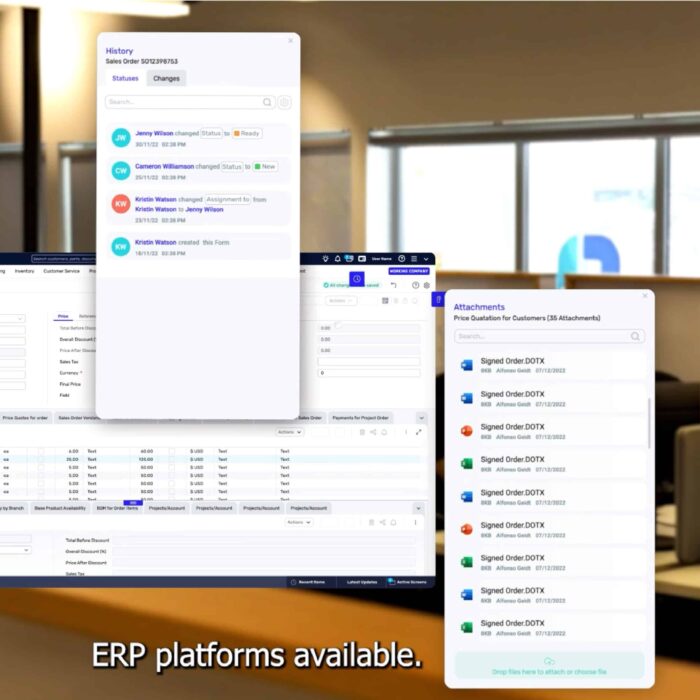

How does ERP impact financial management?

ERP has a significant impact on financial management by centralizing and automating financial processes within an organization. It integrates various financial functions, such as accounting, budgeting, invoicing, billing, and financial reporting, into a single cohesive system. This streamlines financial operations, reduces manual errors, and enhances data accuracy. ERP provides real-time visibility into financial data, enabling better financial analysis, forecasting, and decision-making. With a centralized database, financial information is easily accessible and can be shared across departments, improving collaboration and financial transparency. Additionally, ERP facilitates compliance with financial regulations and auditing requirements, ensuring financial data security

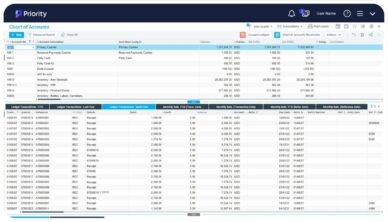

Can financial management ERP be used for accounting?

Yes, financial management ERP can be used for accounting. ERP systems often include a robust financial management module that handles various accounting functions, such as general ledger, accounts payable, accounts receivable, bank reconciliation, and financial reporting. These systems automate and streamline accounting processes, reducing manual efforts and errors. They offer real-time access to financial data, enabling accurate and up-to-date financial reporting and analysis. With integrated financial management capabilities, ERP systems serve as comprehensive accounting solutions that support efficient financial management, compliance, and decision-making within an organization.

What is the difference between ERP and financial system?

The key difference between ERP and a financial system lies in their scope and focus. ERP is a comprehensive integrated software suite that covers a wide range of business functions across an organization, such as finance, HR, supply chain, manufacturing, sales, and more. It facilitates data flow and information sharing between different departments, promoting efficient coordination and providing a centralized view of the organization's operations. On the other hand, a financial system is a software solution specifically designed to manage financial-related processes, such as accounting, budgeting, invoicing, and financial reporting. While ERP includes financial management as one of its modules, a financial system is more specialized and concentrated solely on financial functions. While ERP offers a broader and more all-encompassing approach to managing business operations, a financial system is specifically focused on handling financial data and processes.

Can Financial Management ERP handle compliance requirements?

Yes, Financial Management ERP can handle compliance requirements effectively. These ERP systems often include features and tools designed to support compliance with various financial regulations and reporting standards. By automating financial processes and maintaining accurate and auditable records, ERP helps ensure adherence to compliance requirements. It facilitates the generation of financial reports in line with regulatory standards and provides real-time access to financial data, making it easier to demonstrate compliance during audits. Additionally, ERP's role-based access control and data security measures contribute to maintaining the confidentiality and integrity of financial information, further supporting compliance efforts. Overall, Financial Management ERP systems play a crucial role in helping organizations meet their compliance obligations and minimize the risk of non-compliance issues.

Does Financial Management ERP facilitate multi-currency and international financial management?

Yes, Financial Management ERP systems facilitate multi-currency and international financial management. These ERP solutions are designed to handle transactions and financial data in multiple currencies, allowing businesses to conduct operations and manage finances in different currencies for international transactions. ERP's multi-currency capabilities enable accurate and real-time currency conversions, making it easier to record and report financial data in a standardized currency format. This functionality also supports international financial reporting, helping businesses comply with diverse accounting standards and regulatory requirements in different countries. With multi-currency support, Financial Management ERP systems are well-equipped to manage the complexities of international financial operations, providing businesses with the tools they need for effective global financial management.

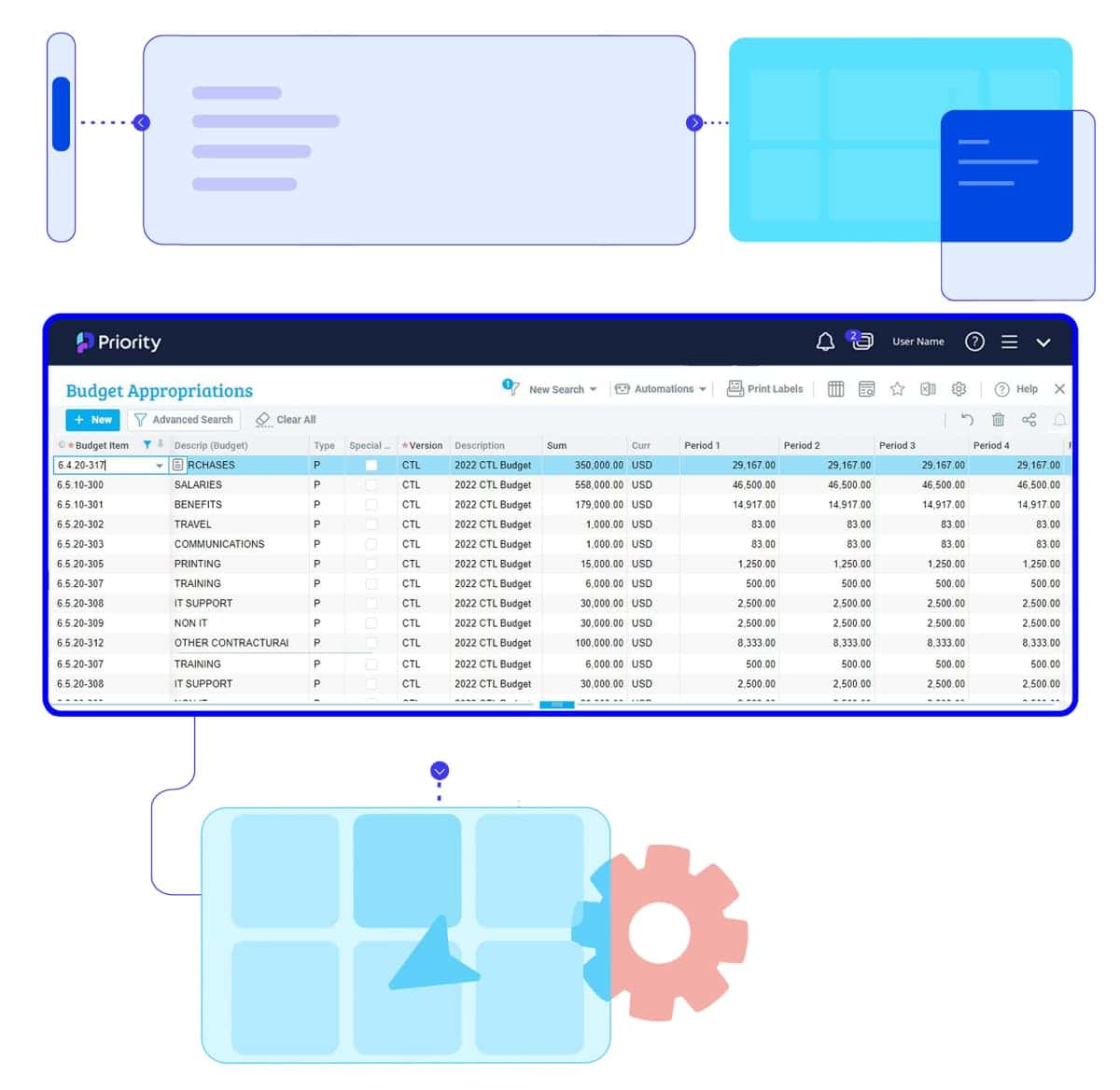

Can financial management ERP help with budget planning and forecasting?

Yes, financial management ERP systems can significantly help with budget planning and forecasting. These ERP solutions offer comprehensive budgeting and forecasting functionalities that allow businesses to create, manage, and analyze budgets for various departments and projects. ERP's integration with financial data ensures that budgeting is based on real-time and accurate financial information. The system enables users to compare actual financial performance against budgeted figures, identifying areas for improvement and making data-driven decisions. Forecasting tools within ERP help businesses project future financial performance based on historical data and market trends, enabling them to anticipate financial outcomes and plan accordingly. This budget planning and forecasting capability empowers businesses to make informed financial decisions, align resources effectively, and achieve their financial goals more efficiently.

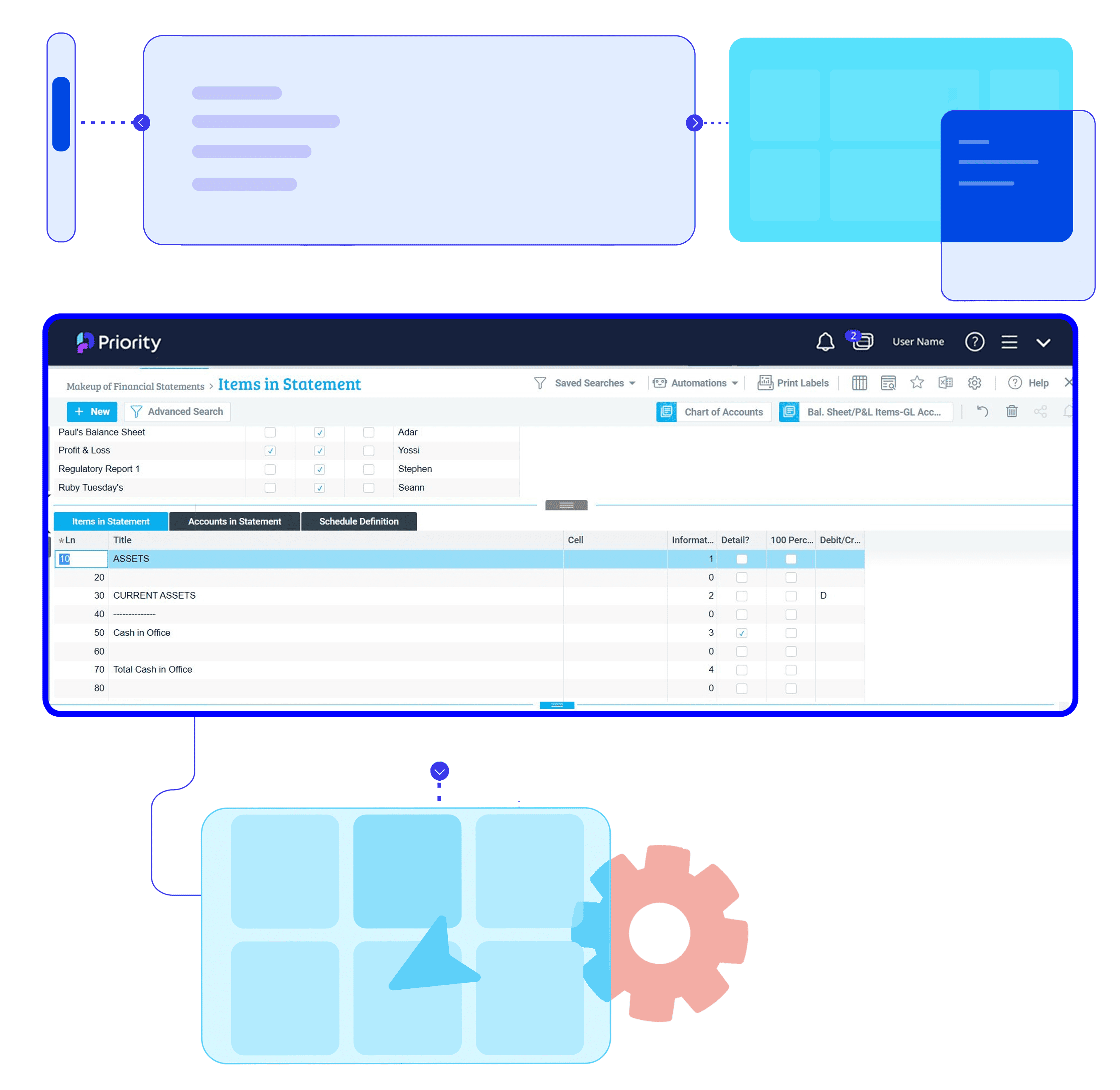

Is Financial Management ERP customizable to suit specific financial reporting needs?

Yes, Financial Management ERP systems are typically customizable to suit specific financial reporting needs. These ERP solutions offer various tools and options to tailor financial reports according to an organization's requirements. Users can create custom financial statements, charts, and graphs, selecting the relevant financial data to be included. ERP systems often allow for report formatting, branding, and the inclusion of custom data fields. Additionally, users can define specific criteria and filters to generate specialized reports for different departments or stakeholders. The customization capabilities of Financial Management ERP empower organizations to present financial information in a format that aligns with their unique reporting needs, ensuring clarity and relevance in decision-making processes and meeting the specific demands of regulators, investors, and management.

What industries can benefits from Financial management ERP?

Financial management ERP can benefit a wide range of industries. Industries that involve complex financial transactions and require efficient management of financial data can particularly benefit from these systems. This includes but is not limited to industries such as manufacturing, retail, distribution, healthcare, construction, professional services, financial services, and non-profit organizations. Financial management ERP streamlines financial processes, facilitates accurate accounting, and provides real-time insights into financial performance. It enables businesses to manage budgets, forecast financial outcomes, handle multi-currency transactions, comply with regulatory requirements, and make informed financial decisions. The flexibility and adaptability of financial management ERP make it a valuable tool for diverse industries seeking to optimize their financial operations and enhance overall business performance.