- Full support of multi-company, multi-lingual, and multi-currency management along with a wide variety of localizations

- Simple integration of data and management of multiple organizations with consolidated reports

- Seamless connectivity between departments customers, etc., for fast and smooth operations

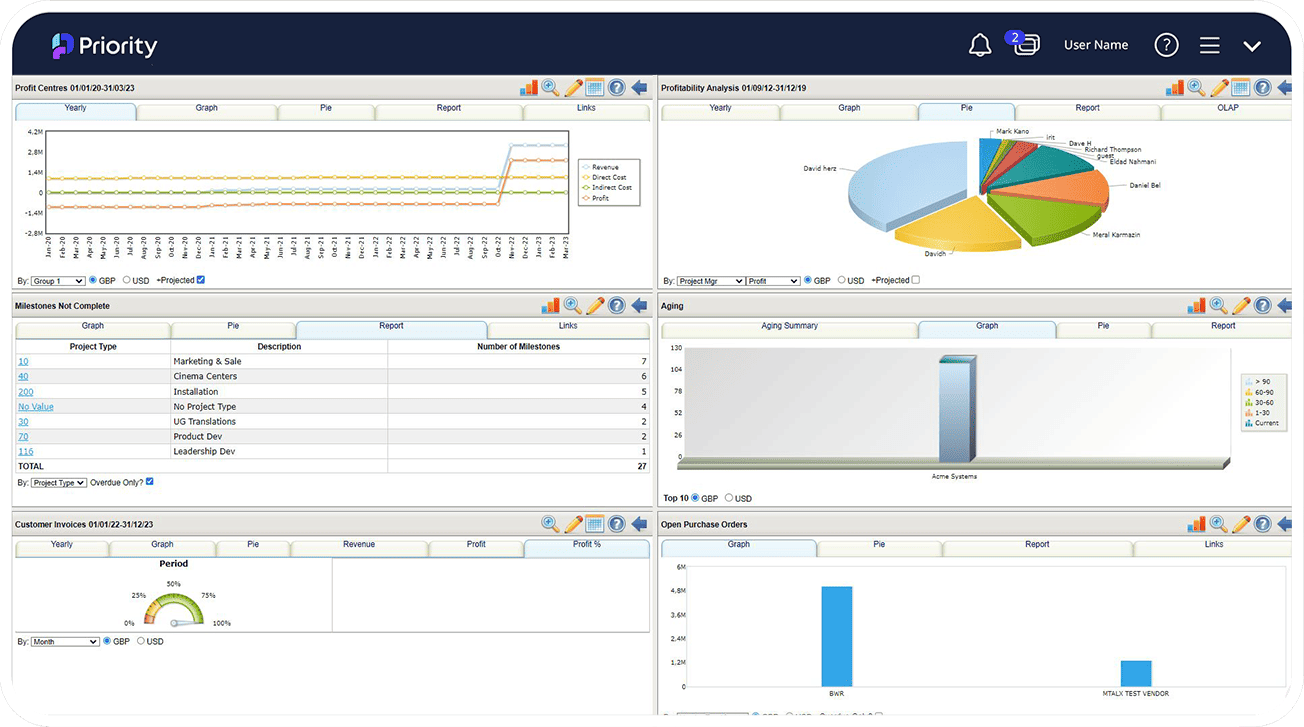

- Pre-defined reports and a report generator allow for better-informed decisions

- A holistic view into financial data via multi-dimensional report analysis, across legal entities, divisions, or any other parameter

- Compliance with changing regulations

Full financial visibility

Priority's financial services ERP is a comprehensive offering designed to help financial service companies (banks, investment banking firms, insurance companies, tax and accounting firms, credit card companies, lenders, brokerage houses, etc.) automate and manage their operations, including billing, payments to vendors, fixed assets, cash management, cost and budget control, human resources, built-in reporting, project management, and more. Along with Priority’s process automation and financial insights, financial service companies benefit from a high level of accuracy in strategic decision-making, improved control, and smarter workflow management.

Fire up your operational performance

Key Features

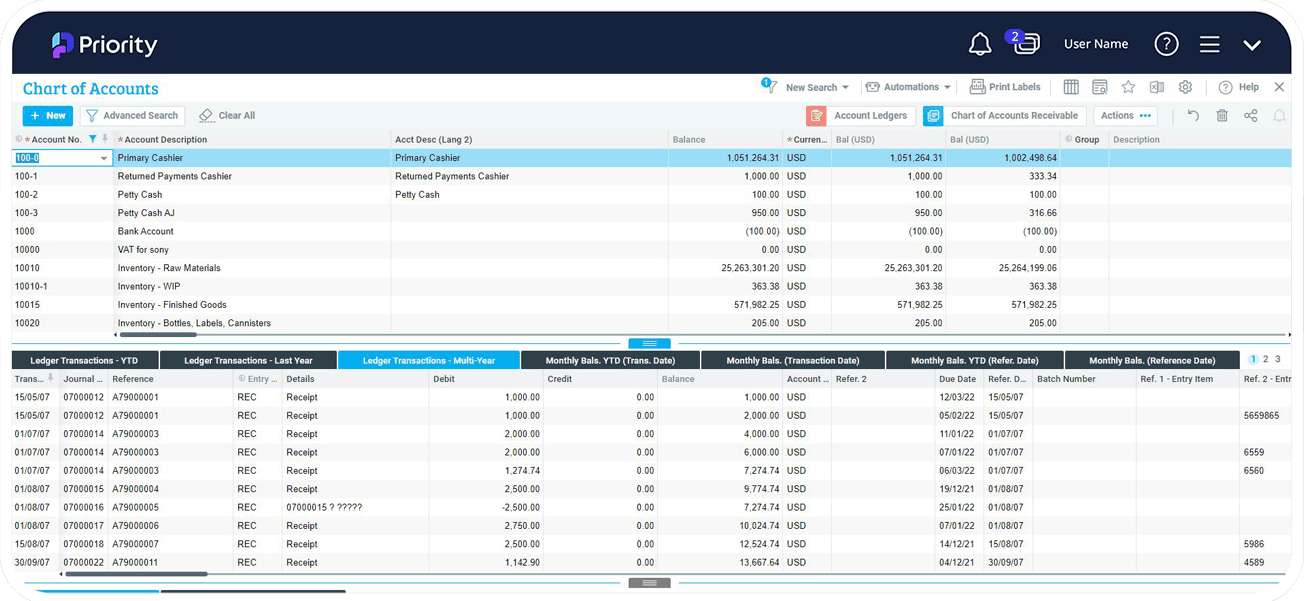

Accounting

Management of financial transactions, such as invoicing, payment processing, and financial reporting. Automation and optimization of a variety of accounting tasks, including managing accounts payable and accounts receivable, maintaining the general ledger, and reconciling financial records. These features can help automate and streamline accounting processes, provide real-time visibility into a company’s financial position, and ensure the accuracy of financial records.

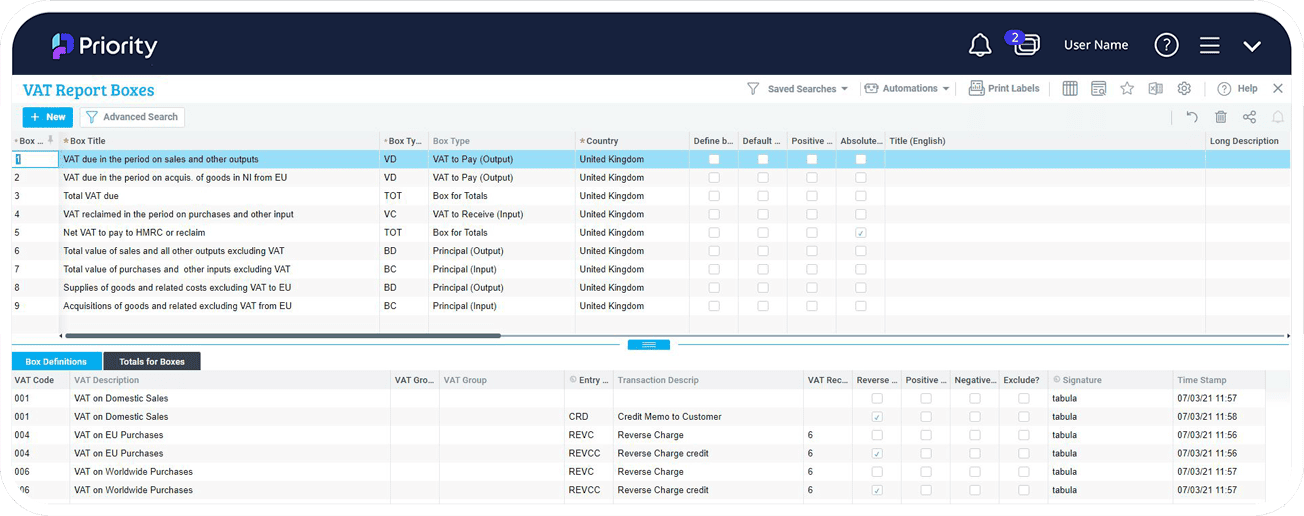

Regulatory and Tax Compliance

Clear, relevant, reliable, and vital financial regulatory compliance and control tools to efficiently manage compliance with financial regulations, such as the (GAAP) or (IFRS) help organizations enforce industry-specific regulatory compliance and track, verify, and audit transactions.

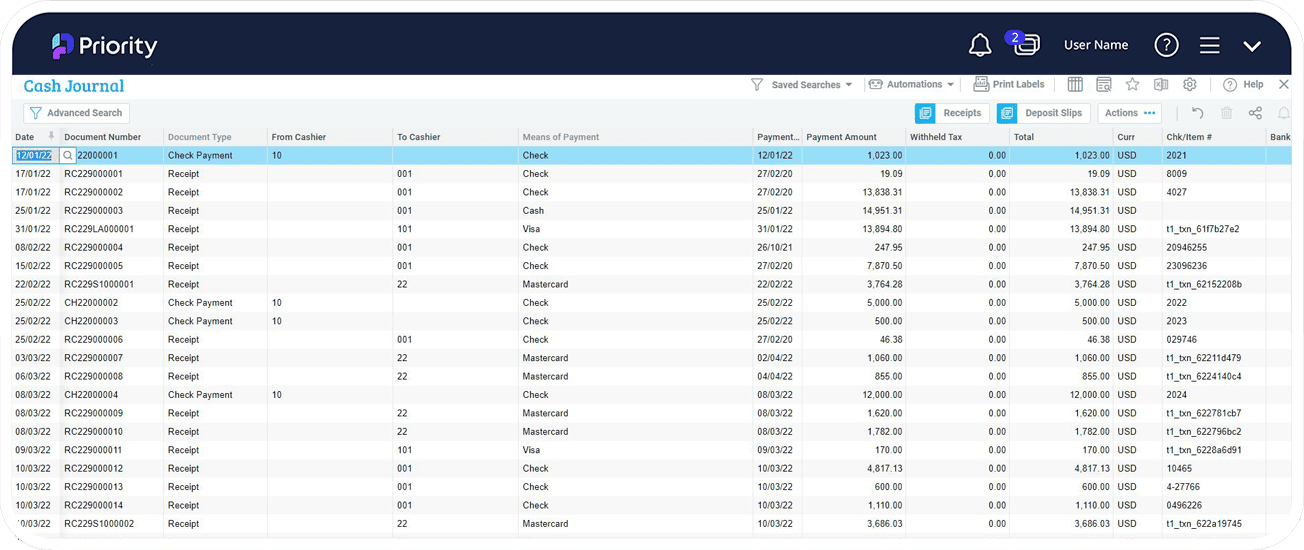

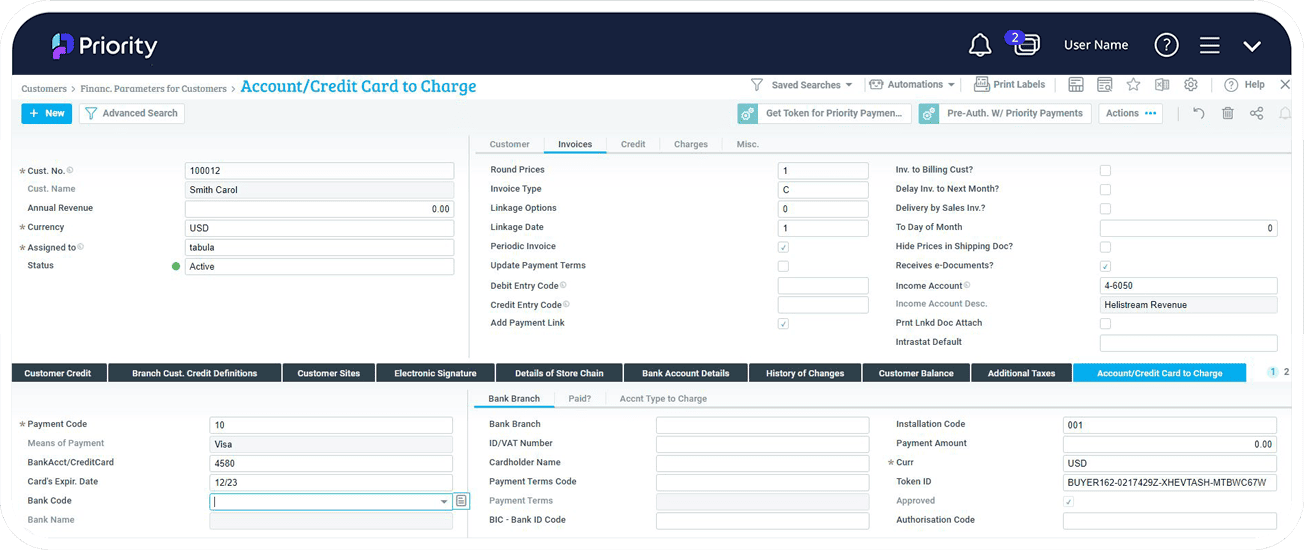

Cash Management

Streamlined and optimized financial processes through real-time visibility into financial transactions and automated payment processing allows for better-informed decision making. Financial management is more convenient, allowing for easy checking of account balances, fund transfers, bill payments, and other tasks with the help of digital banking.

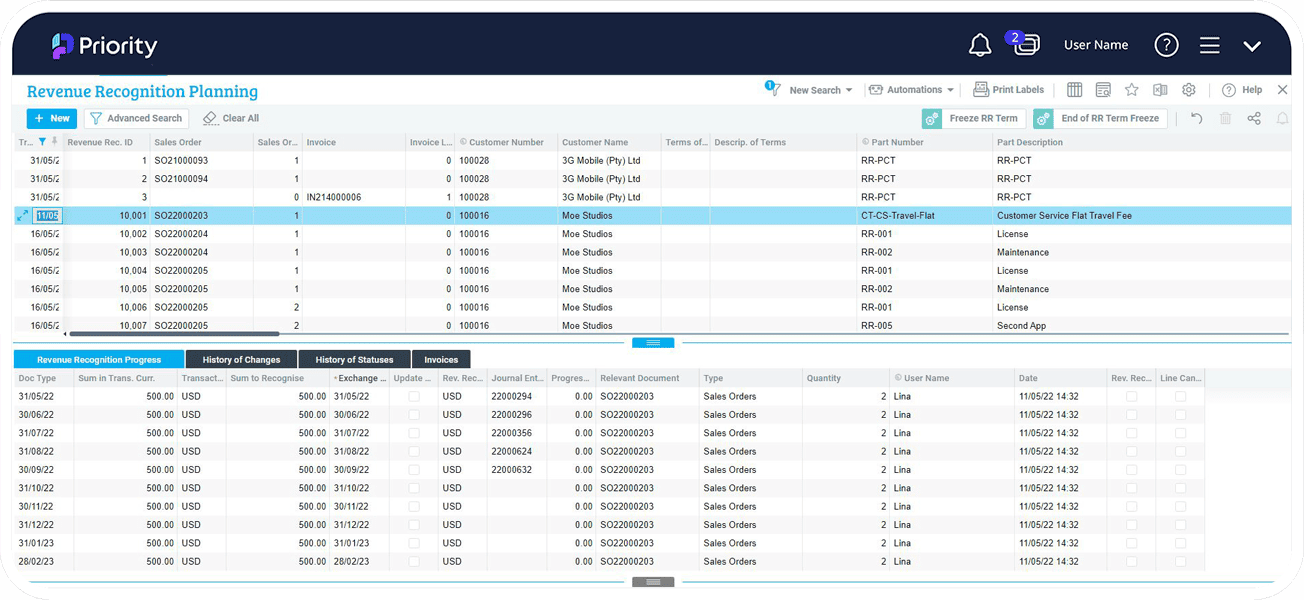

Billing

Customers are billed based on best-practices with a variety of billing methods and functions, including project-based billing, recurring revenues, delivery-based billing, revenue recognition, and more. Invoicing and cash flow management is automated rather than a labor-intensive, time-consuming, and error-prone manual process.

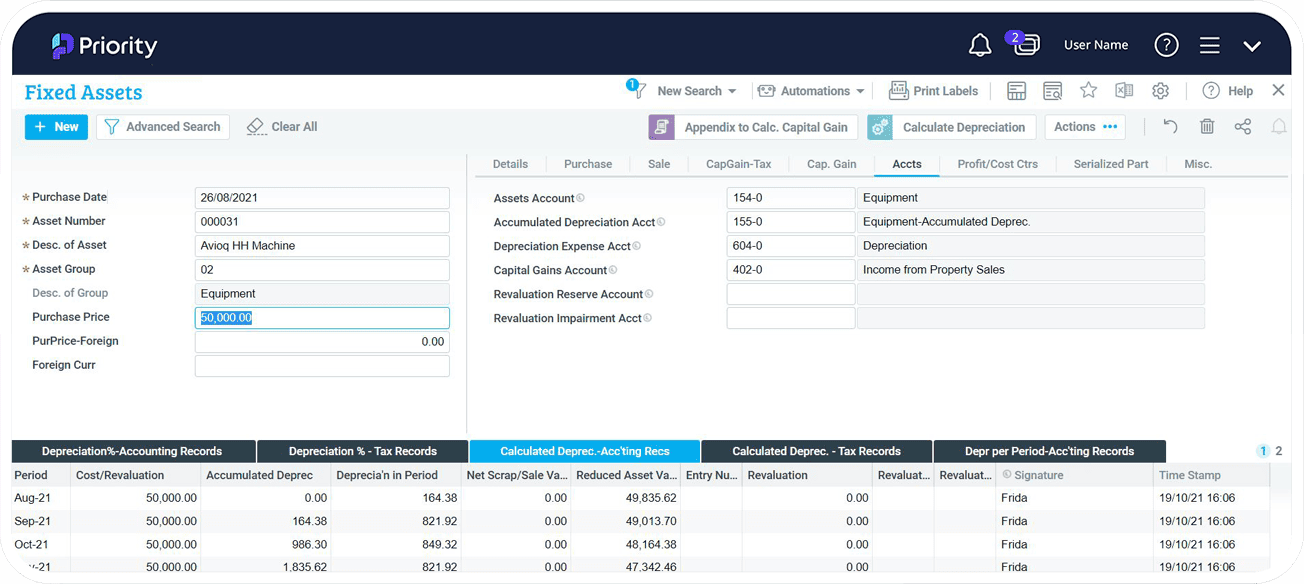

Fixed Assets

Manage the end-to-end process of the fixed assets lifecycle, with seamless integration to accounts payable, inventory management, and general ledger. Manage sales, and calculate tax and box depreciation, proposals, adjustments, and revaluations through multiple methods of business asset input that can also be recorded automatically in a fixed asset journal and save time and effort on back-office management of assets operations.

Sales Targets & Forecasting

Effectively manage sales targets at all levels of the organization based on various dimensions such as region, timeline, sales rep, product line, and quantity. Gain insights into sales performance, adapt to changes easily, estimate future sales, and analyze real-time data to make informed business decisions and predict short- and long-term performance with our sales target management solution.

Customer Service

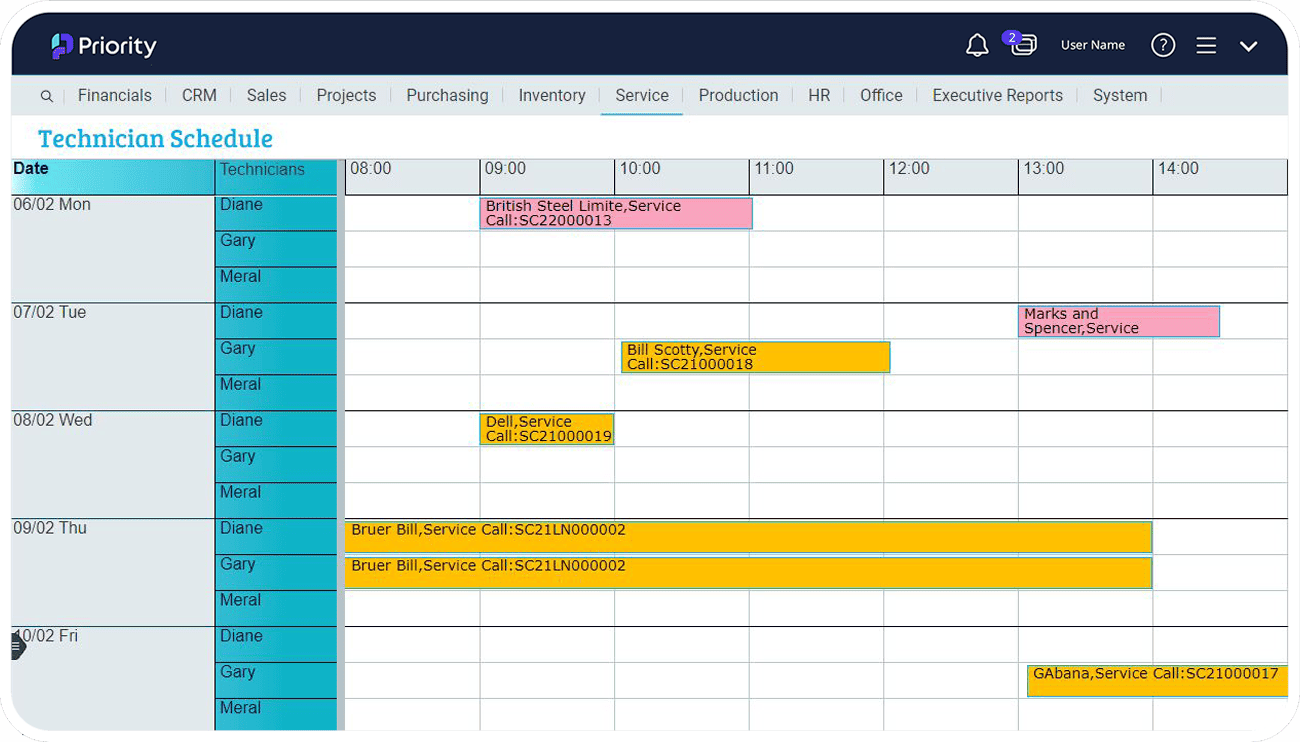

Achieve real-time visibility and tracking of sales orders, physical distribution, billing, and invoicing with our solution. Use our tools to process sales forecasts, orders, and shipping schedules, and track open service calls, call assignments, escalation status, related communications with the customer, and follow-up calls with our Call Center reporting functionality. Enhance the customer experience and deliver quality and timely service and support.

Case Studies

FAQ’s

Can an ERP system be customized for the specific needs of a financial services organization?

Yes, many ERP systems are highly customizable and can be configured to meet the specific needs of a financial services organization. This may include customizing the modules and features that are included in the system, as well as integrating with other systems or external data sources. It is important to work with a vendor or consulting partner that has experience implementing ERP systems for financial services organizations, as they will be able to help you choose the right system and customize it to meet your needs.

How is ERP used in Financial Services?

Enterprise resource planning (ERP) systems are used in financial services to manage and integrate various business processes, such as accounting, human resources, customer relationship management, and supply chain management. ERP systems can help financial services organizations streamline operations, improve efficiency, and make better-informed decisions.

What are the advantages of using an ERP for Financial Services?

Some of the main advantages of using an ERP system for financial services include:

• Improved data management: An ERP system can provide a single source of truth for an organization's data, which can help improve decision-making accuracy and reliability.

• Enhanced security: Financial services organizations handle sensitive data and must comply with strict regulations. An ERP system can help to ensure that data is securely stored and managed in compliance with these regulations.

• Greater agility: An ERP system can provide a flexible platform for adapting to changing business needs, such as new regulations or shifts in customer demand.

Why should I use an ERP for my Financial Services organization?

There are several reasons why a financial services organization might consider using an ERP system:

• Improved efficiency: By automating many of the manual processes that are involved in managing financial services operations, an ERP system can help to reduce errors, improve accuracy, and save time.

• Better decision-making: An ERP system can provide real-time insights into various aspects of a financial services organization's operations, such as financial performance, customer behavior, and supply chain management. This can help to inform better decision-making.

• Enhanced customer service: By providing a centralized system for managing customer relationships, an ERP system can help financial services organizations to provide a more personalized and efficient service to their clients.

What modules are usually used in Financial Services?

Several modules are commonly used in financial services organizations, including: Accounting, regulatory and tax compliance, cash management, billing, cost and budget control, revenue recognition, payments, fixed assets and more.